Infosys Company Overview

Infosys Share Price Target 2026: Infosys Limited (NSE: INFY) is a leading Indian IT services and consulting firm with a global footprint across North America, Europe, and Asia Pacific. Known for delivering end-to-end digital transformation services, Infosys helps enterprises modernize legacy systems and adopt cloud, automation, and AI solutions. Its recurring revenue model and diversified client base position it as a cornerstone of India’s tech exports.

The company has consistently returned value to shareholders through dividends and strategic buybacks—most recently an ₹18,000 crore share buyback aimed at enhancing EPS and shareholder returns.

Before diving into future price projections, let’s look at how analysts view Infosys’ earnings and financial health.

Key Financial Metrics – EPS, PE Ratio & ROE

Evaluating a stock’s long-term potential requires understanding its core fundamentals:

- Earnings Per Share (EPS): Infosys’ expected EPS has shown steady growth, with forecasts indicating further rises through 2027.

- PE Ratio: The company’s price-to-earnings ratio is considered reasonable compared to its long-term average, reflecting fair valuation relative to earnings expectations.

- Return on Equity (ROE): Infosys maintains robust ROE, highlighting efficient use of shareholder capital to generate profit—an attractive trait for long-term investors.

Together, these metrics show that Infosys remains financially solid, though external economic conditions and client spending trends will influence performance.

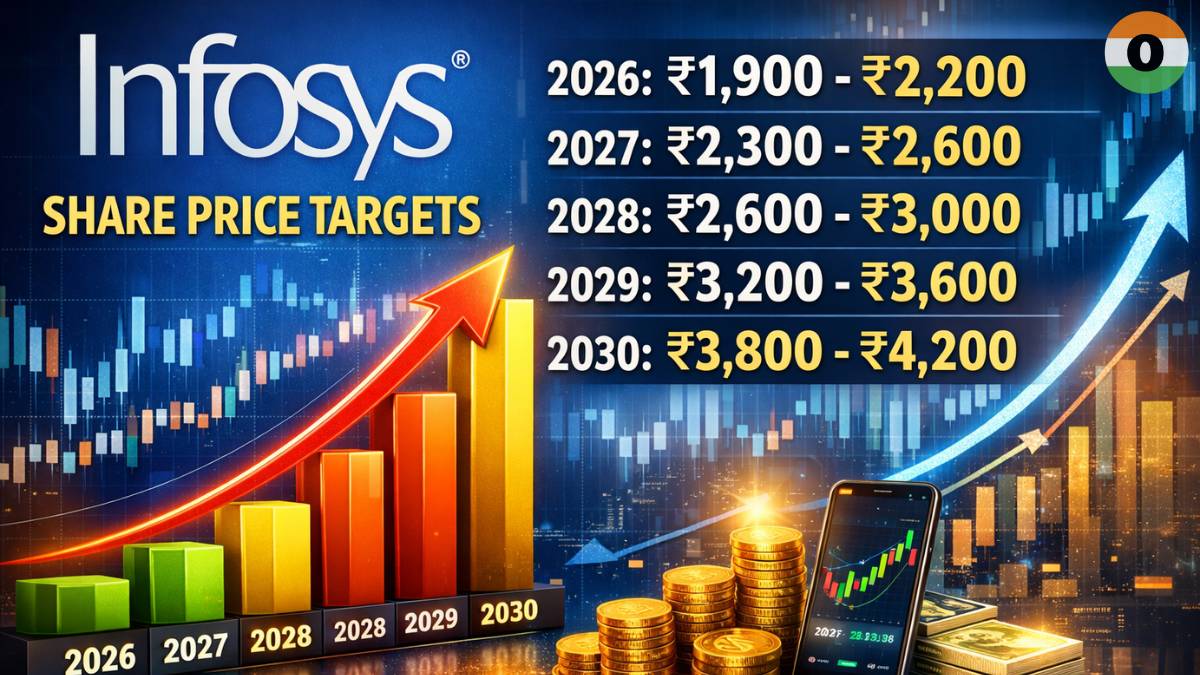

Infosys Share Price Target 2026 – 2030

Predicting future share prices involves a mix of analyst targets, macro trends, and company execution. Below is a consolidated view of forecasted share price targets (in Indian Rupees):

Infosys Share Price Target 2026

For 2026, most projections point to moderate growth as Infosys consolidates its digital and AI offerings. A commonly cited range is ₹1,950 to ₹2,150—reflecting expectations of stable demand and tech spending recovery.

This forecast assumes mild economic headwinds and gradual pickup in discretionary IT budgets.

LG Electronics India Share Price Target 2026, 2027, 2028, 2029, 2030

Infosys Share Price Target 2027

In 2027, analysts expect continued strategic expansion, with targets between ₹2,150 and ₹2,420. Growth drivers include deeper penetration in cloud services and digital transformation projects.

Infosys Share Price Target 2028

Looking ahead to 2028, a potential range of ₹2,420 to ₹2,680 is projected. Adoption of next-generation technologies and consulting services could further lift valuations.

Infosys Share Price Target 2029

By 2029, the market could value Infosys between ₹2,680 and ₹2,950, assuming robust execution and global IT growth. This assumes buoyant demand for outsourcing and digital services.

Infosys Share Price Target 2030

For 2030, long-term forecasts suggest Infosys reaching ₹2,950 to ₹3,280, driven by diversified revenues across traditional IT, cloud, and AI solutions. These numbers imply that, barring severe macro disruptions, Infosys could deliver solid returns over the decade.

Note: Other sources provide more aggressive long-term price projections (e.g., ₹4,000+ by 2030), but such numbers involve higher uncertainty and depend on accelerated global expansion and outperforming peers.

What Drives Long-Term Growth?

Innovation & Services Expansion

Infosys’ investment in automation, AI, and digital services positions it well for clients prioritizing technology modernization. Recent revenue guidance upgrades signal this momentum.

Macroeconomic & Industry Trends

Global tech spending trends, especially in cloud and cybersecurity, will influence IT consulting demand. While cautious spending can dampen growth, digital transformation remains a long-term tailwind.

Shareholder Returns

Capital return initiatives like dividends and buybacks not only reward investors but can support per-share earnings growth—an important underpinning for long-term valuations.

Risks to Consider

No forecast is guaranteed. Challenges such as slower IT spending, regulatory issues abroad, or demand uncertainty could temper growth. Some investors also point to cyclicality in outsourcing demand and competitive pressure from global peers.

Final Thoughts – Is INFY a Buy for the Long Run?

Infosys demonstrates strong fundamentals with steady EPS growth, efficient capital use (healthy ROE), and broad market presence. Future share price targets suggest reasonable upside through 2030 under current forecasts.

As always, diversify your portfolio and consider consulting a financial advisor before making investment decisions.