- Bharat Electronics Share Price Target: Company Overview

Bharat Electronics Share Price Target: Company Overview

Bharat Electronics Share Price Target is closely tracked by long-term investors because Bharat Electronics Limited (BEL) is a key public sector company in India’s defence and electronics sector. The company designs and manufactures advanced electronic systems for the Indian armed forces and government bodies.

Along with defence, Bharat Electronics Share Price Target also depends on its role in civil sectors such as smart cities, railways, space research, and homeland security. This diversified business model supports stable revenue growth over the long term.

Bharat Electronics Share Price Target Based on Fundamentals

The Bharat Electronics Share Price Target is supported by strong fundamentals. The company has a market capitalization of around ₹3,02,113 crore, highlighting its large presence in the Indian stock market. Its return on equity of 26.41% shows efficient use of shareholder funds.

With a debt-free balance sheet and steady earnings, Bharat Electronics Share Price Target benefits from financial stability. A consistent dividend payout and strong government backing further strengthen investor confidence.

Bharat Electronics Share Price Target 2026

Bharat Electronics Share Price Target 2026 reflects steady growth driven by ongoing defence orders and government spending. As India continues to modernize its defence infrastructure, BEL is expected to receive consistent contracts.

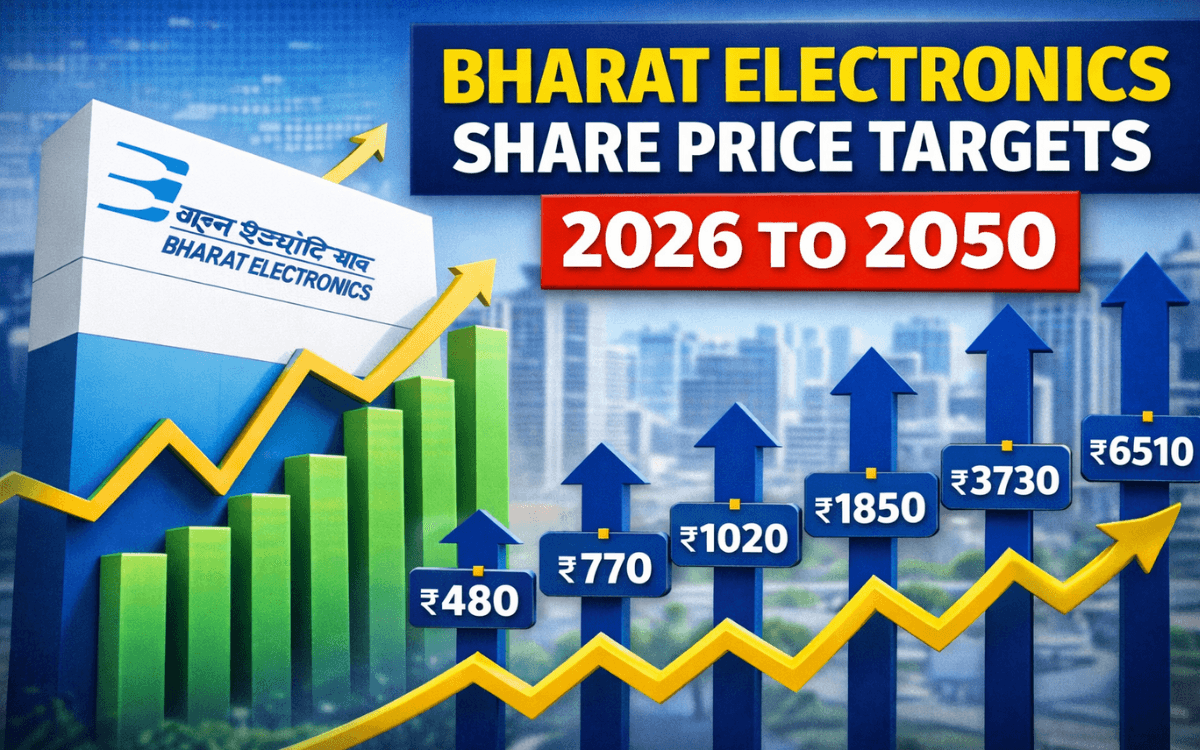

Based on growth expectations, Bharat Electronics Share Price Target 2026 is estimated to range between ₹410 and ₹480. A fair average level near ₹445 represents balanced valuation and stable earnings outlook.

Bharat Electronics Share Price Target 2030

The Bharat Electronics Share Price Target 2030 focuses on long-term defence modernization and increased indigenous manufacturing. BEL’s expertise in radar, communication, and electronic warfare systems supports its expansion.

For this phase, Bharat Electronics Share Price Target 2030 is projected between ₹690 and ₹770. A midpoint around ₹730 reflects consistent revenue growth and improved margins.

Bharat Electronics Share Price Target 2035

Bharat Electronics Share Price Target 2035 considers expansion into advanced defence technology and strategic electronics. By this time, BEL is expected to strengthen its global and domestic footprint.

The projected Bharat Electronics Share Price Target 2035 range is ₹970 to ₹1020. A level near ₹995 fits the company’s expected scale and long-term growth.

Bharat Electronics Share Price Target 2040

The Bharat Electronics Share Price Target 2040 represents a mature phase where the company could dominate defence electronics. Rising demand for advanced military and aerospace systems supports future valuation.

At this stage, Bharat Electronics Share Price Target 2040 may trade between ₹1510 and ₹1850, with an estimated fair value near ₹1680.

Bharat Electronics Share Price Target 2045

Bharat Electronics Share Price Target 2045 reflects decades of sustained growth and technological leadership. The company may play a major role in national security and civil technology projects.

The expected Bharat Electronics Share Price Target 2045 range is ₹3120 to ₹3730, with a balanced estimate around ₹3425.

Bharat Electronics Share Price Target 2050

The long-term Bharat Electronics Share Price Target 2050 assumes deep integration of defence with digital and electronic systems. BEL’s experience and government support become key advantages.

For this horizon, Bharat Electronics Share Price Target 2050 is projected between ₹6050 and ₹6510, with an average estimate of ₹6280.

Bharat Electronics Share Price Target and Shareholding Pattern

The Bharat Electronics Share Price Target is influenced by a stable shareholding structure. Promoters hold 51.14%, FIIs own 18.15%, and mutual funds hold 15.12%, showing strong institutional confidence.

Retail investors also participate, which supports liquidity and long-term interest in the Bharat Electronics Share Price Target.

FAQs – Bharat Electronics Share Price Target

Q1. Is Bharat Electronics good for long-term investment?

Yes, Bharat Electronics Share Price Target benefits from defence growth and government support.

Q2. What supports Bharat Electronics Share Price Target growth?

Strong order book, debt-free balance sheet, and defence modernization.

Q3. Is Bharat Electronics a government company?

Yes, it is a public sector undertaking under the Government of India.

Q4. Does Bharat Electronics pay dividends?

Yes, dividend income supports Bharat Electronics Share Price Target stability.

Disclaimer

This article on Bharat Electronics Share Price Target is for educational purposes only. It is not investment advice. Please consult a SEBI-registered advisor before investing.

Also Read